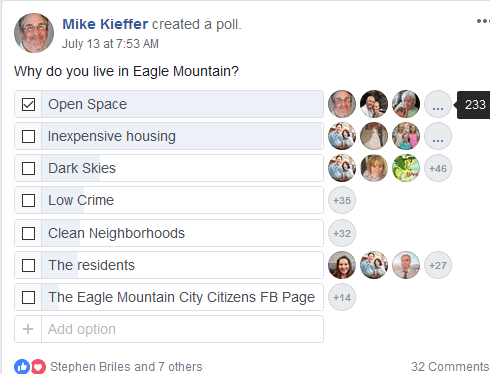

On July 13th, I did a Facebook poll on the Eagle Mountain Citizens FB page. The page has over 7,500 members that live in and around Eagle Mountain. The question I asked was, “Why do you live in Eagle Mountain?” I then added poll options as people requested them or suggested reasons in the comments section. The number one reason people live in Eagle Mountain, according to this unofficial Facebook poll, is for the Open Space. The second reason was for inexpensive housing.

This idea is also supported by the recent citizens survey that the Eagle Mountain City Staff recently published the results of.

The concepts of Rural, Quiet, Open Spaces, Night Skies were listed as what people like most about living in Eagle Mountain.

But the open space is slowing being replaced by higher density housing. The City Council has been doing some things lately to encourage bigger sized lots. One example was their recent decision to place restrictions on the rezone for the Eagle Mountain Benches project. They also worked with the developer of the Sunset Flats development to insure that some of the area stayed larger open lots, and they removed the multi-family housing.

The General Fund gets a large amount of its revenue from Planning, Building, and Engineering Fees. In the 2018-2019 proposed budget, that fund source will account for $3,075,550 in revenue or 24% of the total revenue for the General Fund. The only revenue source that is larger is the Sales, Property, Utility and Use Taxes. Taxes are projected to bring in $6,570,000 in revenue, or 51% of the total revenue for the fund. It is projected that the City will collect $1,550,000 in building permits. The two other large contributors to that fund are the Plan Checks ($675,000) and Development Fees and Subdivision Inspections ($400,000). Building a larger number of houses in an area will increase the Property Tax revenue as well as increase the Fee revenue.

So how does this financing structure encourage a higher density? Lets break it down in just terms of Building Permits. The following chart shows the amount of money the city will collect based on the number of lots approved for the same amount of land. We are going to, for simplicity, say that there will be a $200,000 home built on each of the lots. For ease in property tax calculation we will also show the Taxable Value for each lot at $200,000 as well. The following chart shows that the higher the density that is approved, the more money the city will collect in fees, and in property tax (2017 effective tax rate .014107% for residential, the cities percentage is .001476847%). A 5 acre property with a single lot will generate $2,409.12 in revenue the first year, but the same property with 40 1/8 acre lots will generate $96,364.80 in revenue for the first year. See chart below for more details on different lot sizes.

| Lot Size | Number of Lots | Building Permit Revenue One Time Fee | Property Tax Revenue Per Year | Total Revenue to City First Year |

|---|---|---|---|---|

| 5 Acre Lot | 1 | $2113.75 | $295.37 | $2,409.12 |

| 1 Acre Lots | 5 | $10,568.75 | $1,476.85 | $12,045,60 |

| 1/2 Acre Lots | 10 | $21,137.50 | $2,953.70 | $24,091.20 |

| 1/3 Acre Lots | 15 | $31,706.25 | $4,430.55 | $36,136.80 |

| 1/4 Acre Lots | 20 | $42,275.00 | $5,907.40 | $48,182.40 |

| 1/8 Acre Lots | 40 | $84,550.00 | $11,814.80 | $96,364.80 |

It should be noted that this is the minimum the city would collect for a lot with a $200,000 dollar home. The city also collects inspection fees, utility hookup fees, impact fees, and other miscellaneous fees for each lot. The greater the number of lots per acre, the greater the revenue collected in the first year.

In 2017 87% of permitted lots in the city were for less than 1/2 acre, as illustrated in the table below.

| Lot Type | # Permitted Lots | % of Total |

|---|---|---|

| Base Density (5+ Acre Lots) | 146 | 1.5% |

| Tier I (1/2+ Acre Lots) | 877 | 9.9% |

| Tier II | 6,487 | 73.2% |

| Multi-Family | 1,349 | 14.3% |

I don’t know what the solution is to encourage lower density and more agricultural building in Eagle Mountain. The fact that the city currently receives 24% of its general fund revenues from building fees, should cause some concern. What happens to that 24% income if the building market collapses or if it slows in Eagle Mountain. One solution would be to shift some of that growth from residential to commercial development. Commercial development brings in more property tax revenue, as well as sales and use tax. I would like to note that in 2014 the actual budget showed that $2,245,317 was collected in sales tax, and that revenue increased to $3,740,000 in the 2018 budget.

I don’t think the answer is an easy one, but if the city values its open space, it needs to find other sources of revenue. The current path the city is on will eventually require a change. When building stops and the open space has been developed the cities hand will be forced, and additional funding stream will need to be found. Eagle Mountain is currently the 5th largest city in Utah based on geographical size. This geographic size gives the city area for development and to collect building fees on, allowing the current revenue model years of success in the future. Hopefully the City Council will continue to make one of the main reasons why people move to Eagle Mountain, the Open Space, a high priority.

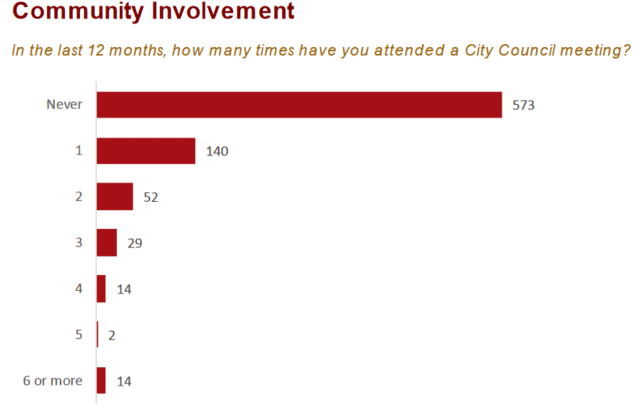

The downside is that the city has little involvement by its residents in City Council meetings. The survey the city did in 2018 asked the question, “In the last 12 months, how many times have you attended a City Council Meeting?” Only a handful of residents said that they have attended City Council meetings, and even a smaller amount attend on a regular basis.

Because of this lack of involvement with residents and the City Council, the idea of Open Space can easily be replace by revenue goals as well as the goals of the Developers. If residents want to keep the Open Space, they need to also be involved, and let the City Council know how they feel about additional items on the City Council agenda.

Mike Kieffer – Editor-in-Chief, Cedar Valley Sentinel

Mike Kieffer is a dynamic leader and community advocate based in Eagle Mountain, Utah. He serves as the Editor-in-Chief of the Cedar Valley Sentinel, a local publication dedicated to informing, inspiring, and elevating the Cedar Valley community through honest and accurate journalism. With a passion for fostering connections, Kieffer has made it his mission to highlight local businesses, provide reliable news, and support community development.

Beyond his editorial role, Kieffer is the owner of Lake Mountain Media, LLC, a company specializing in media and communications, and the co-owner of Quail Run Farms, which focuses on sustainable farming and community engagement. He also actively contributes to the local economy and culture as a member of the Eagle Mountain Chamber of Commerce.

Kieffer’s dedication extends to preserving and promoting the history and heritage of the Cedar Valley area. He often participates in community-centered events and media, including podcasts that explore the unique aspects of life in the region. Through his varied endeavors, he remains a steadfast advocate for the growth and enrichment of the local community.

Community involvement is definitely important for the council to recieve feedback. We should encourage the council to consider some innovation, because our time is rare.

If people can’t come to the meetings for whatever reason, then bring the meetings to them. Stream and allow for appropriate comment feedback. The facebook survey was using one media that I personally don’t have, but the questions answered clearly show without any doubt that higher density is not Eagle Mountain.

One data center will bring many more. With strong and smart negotiating Eagle Mountain can get it’s higher than average per acre tax revenue. However, I do caution the Eagle Mountain council. They need to step back and remember that they are a city-community and not a business.

Higher density should not be their main arguments for seeking more money. Consider what comes from high density; increased resident income dependecy, crime, spearheaded social programs, city maintenance, and education struggles. All of these cost the city and state more or they can focus on large businesses needing few employees building remotely that pays off long term.

I attended the recent UDOT public meeting because they communicated periodically the meeting details for attendance. I can imagine over 100 attended because they knew about it. Don’t rely solely on Facebook.